July 22, 2014

Buckle up – The Economy Might Be a ‘Yellen’

original article written by Net Advisor™

WASHINGTON DC. Meet Janet Yellen. Janet Yellen was nominated by President Barack Obama in 2010 to be the Vice-Chair of the Federal Reserve. Yellen was confirmed by the Senate Banking Committee (56-26 vote, 11 Republicans confirming) in January 2014 to be the new Federal Reserve Chairman.

Thus far, Janet Yellen has substantially continued the same policies as former Chairman Ben Bernanke.

Politically speaking, Janet Yellen is further left (Liberal Democrat) than Ben Bernanke – a Republican, but Bernanke’s policies moved more liberal when President Obama took office in January 2009. Our view is Obama pressured Bernanke to push for multi-trillion dollar stimulus programs that Congress or the voters would never support.

Yellen has reduced the FED stimulus programs slightly. Our view is that the stimulus has just been artificially inflating a pseudo economy, and is not without risk. We call it a pseudo economy because the only thing that really has been booming is the stock market. Despite job recovery gains, 57 percent of new jobs are low-wage, 20 percent of households have no job, household income is down, and average unemployment rate is higher under Obama.

On the other upside, real estate has come back some but mostly by investor groups and foreign buyers. This is also happening in areas such as London.

Yellen has discussed increasing interest rates, as early as post 2014 election. If the FED embarks on a slow climb (quarter-point) consecutive interest rate hikes, the U.S. economy risks recession again within 12-18 months after the first rate hike.

If one takes a look at the last 15 years of the FED’s actions when they went on a interest rate hike trend, it didn’t work out too well.

FED Rate Hikes During 1999-2000

- Result: 2000-2002 Dot-com bubble bust, stocks tanked, many stocks went through a painful sliding crash (30-50%+ drop over this period). The U.S. economy went into recession for roughly 2 1/2 years. As of the post date of this article, the NASDAQ market has never recovered from it’s March 2000’s high’s – over 14 years later. The Dow and S&P 500 Index did recover from their year 2000 highs and have gone higher.

FED Rate Hikes During 2004-2006

- Result: 2007-2009ish The mortgage, real-estate market collapsed, took down some 500 banks, plus investment banks (Bear Sterns, Lehman Brothers), plus the largest insurance giant AIG. Many other financial lenders and investment firms did or nearly went under. Many stocks went though a painful sliding crash (40-70%+ drop over a two-year period). The U.S. economy nearly collapsed during one week in Sept 2008, and almost again in early 2009.

I’d argue the U.S. economy is more fragile now that it was in 1999 or in 2006.

I predict the stock market will begin a modest or greater correction (20 percent) on the whiff of rates really going higher. It is possible that if the market is in a really bad economic environment, it could retest the 2009 lows, reversing the entire FED stimulus. The later prediction is a more worst case scenario, but it remains a possibility as I discuss further.

The stock market reversed all the gains it made during the dot-com heyday from March 2000 to about October 2002. The stock market reversed all the gains it made from 2002-2007 real estate boom by 2008. In fact, at the September 2008 lows, the stock market reversed all the gains it had made back to about 1998.

The overall market (ex-NASDAQ) did recover but the decline was painful for most, and people tend to panic sell. Those in weak stocks, generally didn’t fair as well as major indexes such as the Dow and S&P 500 Index.

Some of this next economic and market correction pain can be reduced or avoided (with ‘normal’ corrections 5-10 percent) with the right people in government doing the right things. So far there is epic failure on both sides of the political isle to properly address any of the fiscal and long-term debt issues I have discussed.

U.S. Debt: The Next Economic Risk

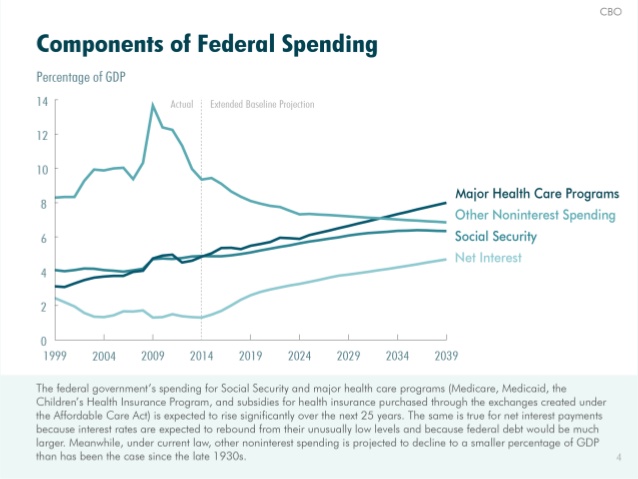

A huge concern is the U.S. National Debt. Higher interest rates mean that more tax dollars will go to paying just the interest on the national debt [$17.6 trillion as of this post] see current number.

In April 2013, I discussed the U.S. and global debt-to-GDP and risks of these deficits. Over a year later, the Congressional Budget Office (CBO) concluded in their July 2014 report that the current trend of U.S. debt-to-GDP is “unsustainable.”

“With large and growing deficits, debt would exceed its current percentage of GDP after 2020 and continue rising, a path that ultimately be unsustainable.”

— Source: Congressional Budget Office (CBO), July 2014 (CBO Slide #18-638) (Full Report, PDF 144pps)(link only)

Borrowing more money from China or printing more money by the FED, then using that printed money to buy government debt (US Treasury Bonds) that the government uses to finance its deficits will only decrease the value of the U.S. dollar. It will also add to real inflation (includes food and energy)(2010 Report, 2012 Report). All of this pushes the U.S. economy at an ever greater risk in the future as I predicted and the CBO has just confirmed.

So good luck with those interest rate hikes.

- Read more reports on the U.S. deficit.

original content copyright © 2014 NetAdvisor.org® All Rights Reserved.

NetAdvisor.org® is a non-profit organization providing public education and analysis primarily on the U.S. financial markets, personal finance and analysis with a transparent look into U.S. public policy. We also perform and report on financial investigations to help protect the public interest. Read More.