March 24, 2014

What You Need to Know BEFORE Buying Health Insurance [Part II]:

Choosing a Provider

HealthCare Education Series written by Net Advisor™

This is Part II (“Choosing a Provider”) of our eight-part series on information to help you understand about health insurance costs, choosing the right plan for you, and how the industry works.

Now that we have the basics of insurance covered, let’s look at what to consider when choosing a health provider.

[6] Do I Pick a HMO (includes Kaiser) or a PPO?

A. What is a HMO?

A Health Management Organization or HMO is a managed care organization where the insurance company has controls over the doctor and every step of your healthcare. You have a primary care physician (“PCP”) who is pretty much what we call in the industry as a “gatekeeper.” The doctor’s job is not to take care of you as he or she might ordinarily want to, but rather to do the very minimum medically necessary.

There is a contract between the insurance company and medical doctor or medical office – something you will never see. The contract states what procedures the insurance company will pay and how much the insurance company will pay. The doctor is likely to have a cap on how much the insurance will cover of the doctor’s actual costs. You may end up covering some or all of the balance depending on what the negotiated rate was between the doctor and the insurance company for the particular visit or procedure.

If you need to see a medical specialist, it will not be up to you if you have an HMO. The HMO doctor will delay in many or most cases before referring you to a specialist, let alone surgery.

The HMO doctor may also use a lesser treatment such as limited physical therapy, x-rays instead of MRI’s, pain pills instead of surgery and ‘just wait it out’ and ‘let’s see how it goes’ and ‘come back and see me’ periodically.

Some medical offices may not even accept you as a patient based on your insurance type. HMO’s, Medicare and Medicaid are more likely to get refusal of service by some, not all, but some medical offices than those with a PPO plan. They might just say something like this: The doctor isn’t accepting any new patients at this time; or isn’t accepting (fill in plan type they are not accepting). Some medical offices will add, will accept new patients with PPO insurance plans.

- HMO Benefit: Lower cost than the typical PPO plan.

- HMO Downside: Health decisions are up to someone else, not you. May take longer time to get treatment.

If you want more control over what doctor you can see, what type of doctor you can see, and when, you want a PPO. It will cost more than an HMO, but putting decisions in your hands is the benefit.

B. What is a PPO?

A Preferred Provider Organization or PPO is a more open network of medical care where you have more control of the care you want or need. You can go to your regular doctor if you want, but you can also go straight to a specialist within your network if you want.

Depending on what the issue is, you might try the regular doctor first. I would try not to monopolize the specialist’s time if the issue was not critical or unless the regular doctor could not solve the issue within a reasonable period of time, or the regular doctor is just not qualified to treat your specific issue.

A PPO is often where you’ll find the best doctors and hospitals. Sometimes the doctors and hospitals can be found in a PPO and HMO.

From a business end, PPO doctors are more likely to get paid and paid more for medical expenses and procedures than HMO or Kaiser doctors.

A PPO should reduce your stress levels verses working with an HMO, Kaiser or government (Medicare, Medicaid) plan. If you tell a medical provider that you have a PPO, you are likely to be treated far better, and get in quicker than if you tell them you have a HMO plan. This is my industry experience. Individual plan experience may vary.

A PPO usually has a wider coverage area, even out of state. Check your plan.

- PPO Benefit: Patient has more control over what type of doctor or specialist they can see, and when. More likely less wait time to get help. Some doctors/ specialists tend to prefer PPO plans.

- PPO Downside: Often times will cost more than non-PPO plans.

What is also nice about a PPO, is that you can see multiple doctors for their opinion about your medical issue or question. If you are facing surgery, you might want to compare 5-8 specialists’ opinions. You might be surprised how medical opinions vary about the same condition.

I would not tell the doctors you have seen anyone else; nor tell them what other doctors have said about your condition. If you disclose what other doctors have said, the quack doctor will just regurgitate what the previous doctor(s) said. Make each doctor come up with their own independent finding based on their own examination of the issue. Then, based on your own findings and experience with the doctors you’ve seen, you choose which doctor you want to treat you.

An HMO insurance might allow a second opinion, but probably not a fourth, or more. It’s your health, it matters.

C. What is Kaiser?

Kaiser is a lot like socialized medicine, where everything is controlled under a central plan. Doctors tend to be salaried and so does most of the staff. Lower staff may be hourly waged.

My theory is the best doctors in the world are going to want to be independent because if they are really good, they can earn the value of their reputation. They probably spent a fortune in medical school and ongoing studies, involved in clinical trials, other research, which allow them to be a true expert in their chosen field.

Kaiser plans are similar to HMO plans except they have their own doctors; own hospitals and other facilities and they control all the costs within. In most (maybe 99%) of all cases, you are stuck with the Kaiser physicians. This is not to say Kaiser is bad, just that you are very limited to their own internal network.

- Kaiser Benefit: Lower cost* than most other health plans. Many services are in more convenient centralized locations.

- Kaiser Downside: Health decisions are up to someone else, not you. May take longer time to get treatment. With rare exception, you must use Kaiser’s medical facilities and Kaiser doctors.

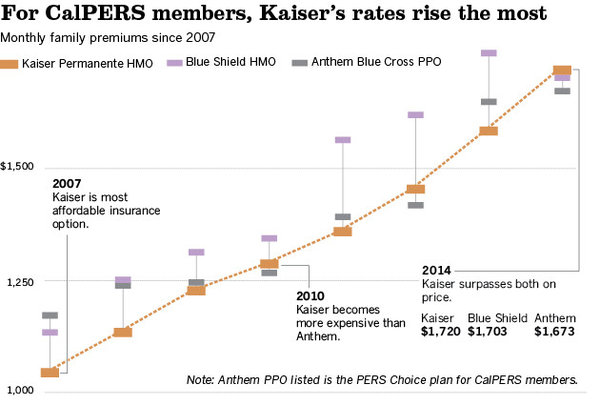

*A recent finding (graphic, top of this page) for employer health plans such as CalPERS (California Public Employees’ Retirement System), said Kaiser plans have become more costly in terms of monthly premium than the two alternative plans in at least California under CalPERS. One must also consider annual deductible and co-insurance rate to determine if the higher premium costs and comparable services are still an advantage or not.

[7] Don’t Assume the Doctor Knows Everything About Medicine.

Not every doctor can be at the top of their class or graduated from a top medical school or have extensive clinical experience. Check out their backgrounds, what schools they went to, how are those schools ranked, how long they have been practicing, what areas do they focus in, and are they qualified to practice in that area.

A doctor, who went to a “B” school but has 20 years of practice, just might be more practically qualified than the doctor who just graduated number one in their class from the top medical school. You also might find registered nurses, and nurse practitioners may have more experience working with patients.

Check out your State Medical Boards or use private commercial web sites such as ConsumerReports.org or HealthGrades.com to review doctors.

Article Series Index:

Part I: Health Insurance Basics

Part II: Choosing a Provider

Part III: HealthCare Planning

Part IV: Risks of Under-Insuring

Part V: The Truth About Health Insurance

Part VI: Navigators (Coming soon)

Part VII: How Your Health Insurance Rates Can Increase (Coming soon)

Part VIII: How to Profit from Your Insurance Company (Coming soon)

original article content, Copyright © 2014 NetAdvisor.org® All Rights Reserved.

Disclaimer: Post intended to be commentary from an insider’s view and based on actual experience working in and out of the industry. Poster’s licenses are currently inactive by personal choice. The information provided herein should not be deemed as specific investment, tax, insurance or legal advice. Rules and laws can change and thus opinions can change without further notice. Individual experiences and situations will vary. All of the data was accurate to the date of this post. Please contact your state or licensed appropriate person for specific advice for your specific needs.

NetAdvisor.org® is a non-profit organization providing public education and analysis primarily on the U.S. financial markets, personal finance and analysis with a transparent look into U.S. public policy. We also perform and report on financial investigations to help protect the public interest. Read More.