09.15.2012

Egan-Jones Downgrades U.S. Credit Rating After FED Stimulus

original article written by Net Advisor™

WASHINGTON, DC. Egan-Jones (official website) announced on September 14, 2012 that the credit rating agency downgraded United States sovereign credit rating from AA to AA-. The news came shortly after the Federal Reserve announced another economic stimulus program “QE3” or quantitative easing #3.

Egan-Jones stated that the FED’s action will actually hurt the economy.

“The FED’s QE3 will stoke the stock market and commodity prices, but in our opinion will hurt the US economy and, by extension, credit quality. Issuing additional currency and depressing interest rates via the purchasing of MBS does little to raise the real GDP of the US, but does reduce the value of the dollar (because of the increase in money supply), and in turn increase the cost of commodities (see the recent rise in the prices of energy, gold, and other commodities).

The increased cost of commodities will pressure profitability of businesses, and increase the costs of consumers thereby reducing consumer purchasing power. Hence, in our opinion QE3 will be detrimental to credit quality for the US.

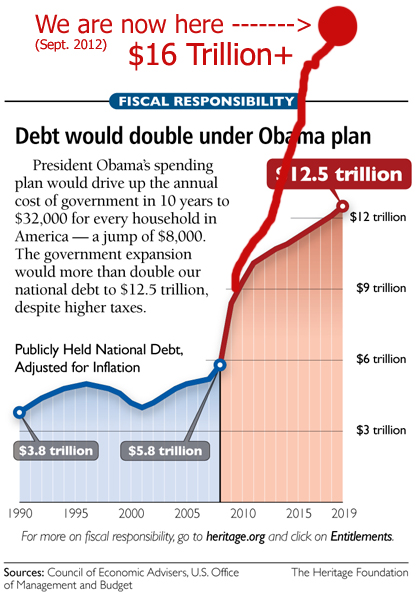

From 2006 to present, the US’s debt to GDP rose from 66% to 104% and will probably rise to 110% a year from today under current circumstances; the annual budget deficit is 8%. In comparison, Spain has a debt to GDP of 68.5% and an annual budget deficit of 8.5%.”

— Egan-Jones Ratings Company (bold added) (Source: Barrons)

- In July 2011, Egan-Jones cut U.S. credit rating from AAA to AA+ on U.S. debt concerns.

- In April 2012, the U.S. was hit with another credit downgrade by Egan-Jones from AA+ to AA with a “Negative Outlook,” again citing deficit issues.

Egan-Jones states they are “an independent NRSRO and not paid by corporations issuing bonds.” As of date of publishing this report, the company’s website suggests that they seem to have a mid 90% rage of accuracy with their ratings since 2001.

Moody’s recently warned of downgrading U.S. credit rating due to lack of control of government reining in spending. Standard and Poor’s (S&P) downgraded U.S. credit rating in 2011.

The FED’s Announcement

The FED recently announced that it would buy $40 billion per month of Mortgage Back Securities (MBS) in effort to lower interest rates which it believes should help the economy. The FED gave no official date when it might end this program. The FED also announced it will continue buying $85 Billion per month of longer-term securities to the end of 2012 (Full statement from the FED (PDF) – highlight added). It should be noted that this stimulus move occurs less than two month before the presidential election.

Our View

We have been arguing that the deficit is a serious problem caused by years of government spending. The Obama Administration has been operating government for the last three years with no budget, spending freely like an endless winning lottery ticket. The only problem is the people who fund that endless lottery ticket for the government are the taxpayers.

In 2012 and 2013 not a single Democrat, Republican or Independent has supported President Obama’s Budget proposals (article, point # [15]).

The only reason the FED announced a third round of stimulus is because the FED knows the economy is not in not the best shape, and it see the economy much worse by next year. Sorry to be the bearer of the news.

Predictions

We believe the unemployment rate could hit over 9% in 2013 no matter who is president. This could be better or worse depending on the policies implemented.

We also predict that the U.S. deficit will increase to $16.5 to $17.5 trillion by the end of 2013.

If cutting government spending (not fantasy cuts), but if real cuts are not part of the government’s near future plans, the economy will head for trouble. Further, if the government thinks that higher taxes is the solution to grow the economy, they will be wrong on that one too.

We would argue that the reason why the FED has launched three stimulus programs is because no one in Congress dares to come out and say ‘the federal government needs to spend more money’.

The 2009 “Obama Stimulus” program resulted in higher deficits, higher unemployment and declining economic growth (please see GNP chart in this report). We would not at all be surprised if the FED is being politicized and doing the bidding of what the Administration can’t do in effort to spike the economy temporarily right before the November election.

Real Time U.S. National Debt Clock

national debt

__________________________________________________________________________

Credits: Images may be copyright of their respective entity where noted.

original content copyright © 2012 NetAdvisor.org® All Rights Reserved.

NetAdvisor.org® is a non-profit organization providing public education and analysis primarily on the U.S. financial markets, personal finance and analysis with a transparent look into U.S. public policy. We also perform and report on financial investigations to help protect the public interest. Read More.

__________________________________________________________________________