03.14.2012 original publish date

04.04.2012 minor updates

05.02.2013 minor edit and added numbered [brackets] for easier referencing

U.S. Deficit Hits All Time Record in February

original article written by Net Advisor™

Washington DC. While most of the current election chatter has to do with trivial news, what is lacking attention in this campaign is the fact the U.S. deficit hit an all time high in February 2012.

[1] Big Spender

According to the Congressional Budget Office (Report PDF), the U.S. government spent $229 Billion more than it took in during the shortest month of the year (February 2012). That’s $229 Billion the U.S. Government spent in ONE MONTH. An International Business Times report (PDF) published on NASDAQ said the government blamed the increase in spending because they had one extra day in February (Leap Year, Feb 29).

[2] Deficit Train Wreck?

The United States is has been on a high-speed economic train wreck that makes Greece’s government spending look like a saint.

The U.S. government has been running consecutive deficits for the last 41 months.

“This is…the 41st straight month that the government has run a deficit.

So far this fiscal year, the government has spent about $1.5 trillion, but has only generated about $869 billion in revenue.”

— Source: CBN

[3] U.S. Government Unable to Pay its Bills Without Borrowing

For the first five months of the fiscal year, the United States government borrowed 42 cents for every dollar it spent.

“The CBO’s figures show that despite repeated efforts to trim spending, the government has borrowed 42 cents of every dollar it spent during the first five months of this fiscal year.”

— Source: Washington Times (PDF)

[4] The Middle-Class Tax Increase Coming after 2014

The CBO noted (page 1, parr 4) that in 2014 more people of “average incomes” will be subject to the Alternative Minimum Tax or “AMT”, effectively a net increase in taxes on the middle-class worker.

“…after 2014 under current law, largely because increases in taxpayers’ real (inflation-adjusted) income will push more income into higher tax brackets and because more taxpayers will become subject to the AMT.”

— Source: Congressional Budget Office (Report, PDF)

Congress has the ability and legislative power to change this, but the question is will they? And if they do, there will need to be off-sets, meaning that the government will need to make serious cuts in spending to off-set any loss of new AMT tax revenues. We discussed this last issue on February 2012 (search caption: “Stealth Tax Hikes for the Middle Class”).

The likely scenario is that the Obama Administration will seek new tax increases on the so-called “wealthiest Americas” to pay more and more of their income until their income is in-line with the average American’s income. At that point, there will be no one left but to tax anyone who is still earning an income.

[5] Unicorns and Fairy Dust: Government’s Magical Numbers

The CBO estimated in the said report that the expiration of the 2002-2003 “Bush Tax Cuts” and the increase in AMT tax revenue from the middle class will stand – meaning Congress will do nothing, and most EVERYONE will be looking at higher taxes in the future.

With these higher taxes, the CBO expects a 2012 estimated deficit of $1.171 Trillion (plus $53 Billion in “off-budget” deficit items). Then, the CBO expects the deficit to be cut in half by 2013 to $612 Billion (CBO Report, Page 2, Table 1, “Deficit (-) or Surplus” compare 2012 to 2013).

This same table (under “Memorandum: Gross Domestic Product”) projects (assumes) that the U.S. economy in terms of GDP will grow 64.87% from 2011 to 2022.

[Math: 2022’s GDP Forecast: $24,655 less 2011’s actual GDP of $14,954 = $9,701. Then, $9,701 divided by $14,954 = 68.87%].

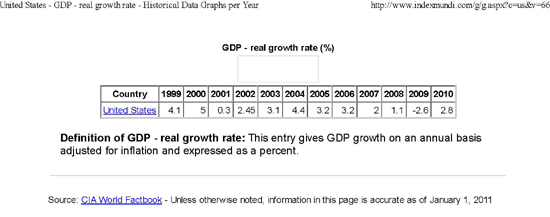

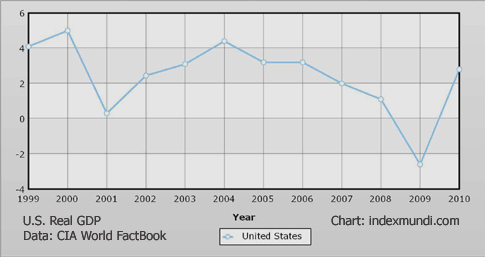

In order for the U.S. economy to grow by 68.87%, the U.S. economy (in terms of GDP) would have to grow by about 6.18% a year, every year, for the next 11 years, with no recession, no slowdown, no risk of anything aversive that could affect the U.S. economy.

[More Math: 68.87% projected U.S. GDP growth divided by 11 years = 6.18% per year of GDP growth needed every year for 11 years in a row, to hit CBO’s 2022 economic growth target].

The only problem is the last time the U.S. economy came close to this growth rate was in the year 2000, when the economy grew by 5%. The U.S. has never seen this growth rate since (please see charts above and below for U.S. historical GDP growth rates).

[6] ObamaCare May Add to the Deficit

The CBO lowered the projected cost of ObamaCare by $48 Billion over 10 years. The CBO assumes certain tax credits, increase in government penalties (for not having a government approved healthcare plan), a decrease in government subsidies, and that about 4 million people will get insurance from other than the government will supposedly decrease ObamaCare costs by $48 Billion over the next 10 years.

Before factoring in the aforementioned lofty assumptions, the CBO estimates the gross cost of ObamaCare to be $1.762 Trillion over the next 10 years. If this money is not allocated in the federal budget, one can also factor interest costs on this new debt making the national debt even a bigger issue in the future.

[7] Summary

The U.S. deficit is growing at an alarming rate. The Obama deficit is on track to exceed the Bush deficit in less than four years instead of eight. The government’s own methodology of projecting significant growth of 6.18% a year for 11 consecutive years with no economic slowdown or setbacks is just not realistic.

The government assumes that about $2 Trillion in higher taxes (ending 2002-2003 “Bush Tax Cuts”) including new taxes on the middle class (via the AMT) by 2014 is the solution to reduce the deficit.

[Side Note: We would challenge and debate the WP article (PDF) that the Obama deficit will increase the national debt by (only) ‘$1 Trillion over 10 years.’

The CBO’s mythical math expects the national debt to be $15.115 Trillion by 2022 (Source: CBO Report PDF, Page 2, Table 1, see “Debt Held by the Public” for 2022).

As of November 16, 2011, the U.S. National Debt already hit $15 Trillion (Sources: ABC News, Fox News, Washington Times). As of March 14, 2012, the National Debt was $15.5 Trillion and counting. This does not include the total U.S. unfunded liabilities which according to U.S. Debt Clock.org exceeds $117 Trillion].

Cutting government spending is something that is not being seriously considered to year 2022 and there is no data beyond that point to suggest that the national debt will decrease at all in the future.

The actual costs of ObamaCare will hit by 2014 (PDF) and there is no real hard data to calculate these future costs since Obamacare was vaguely written (video), which we expect to be “significant” in the future unless scaled back or repealed.

In 2011, part of ObamaCare was permanently repealed as it was found to be financially “unsustainable.”Congress and presidential candidates need to put the deficit on the front burner and explain to the American public how if government doesn’t materially cut spending now, higher taxes will be in store for all of America’s future, and not for just the “wealthy.”

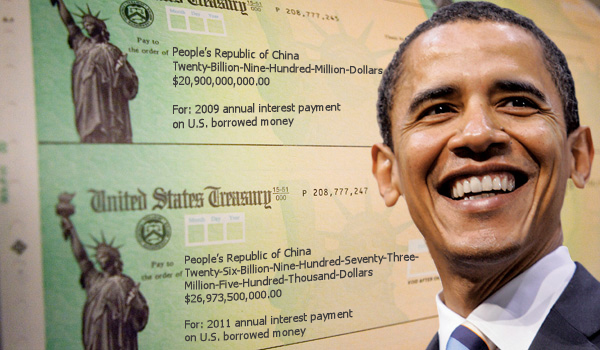

Graphic & Data Credits: Top graphic of President Obama on U.S. Treasury Checks, source: Bloomberg. Modified Bloomberg graphic with text of U.S. treasury payments to China by NetAdvisor.org. Data for U.S. interest payments to China for 2009 and 2011, sources: MS-NBC (2009 data PDF), and politifact.com (2011 data PDF). Politifact.com data calculated by multiplying daily interest to China times 365 days/ year for 2011. Other graphics may be copyright by respective owner(s).

original article content, Copyright © 2012-2013 NetAdvisor.org™ All Rights Reserved.

NetAdvisor.org® is a non-profit organization providing public education and analysis primarily on the U.S. financial markets, personal finance and analysis with a transparent look into U.S. public policy. We also perform and report on financial investigations to help protect the public interest. Read More.