08.22.2011 original publish date

06.27.2012 repaired/replaced broken links

10.17.2013 repaired/replaced broken links / format update for easier referencing.

Market Report: Stocks, Europe and the U.S. Economy

Investor Education Series: Volume II. Issue III.

Original article written by Net Advisor™

Stocks fell toward the end of the day on Friday August 19, 2011 as investors once again raised concerns over European sovereign debt crisis and what appears to be a rapid slowing of the U.S. economy. We still exercise cautiousness.

[1] Quick Market Summary (Friday 08-19-2011)

- Dow -172.93 or 10,817.65 or -1.57% to 10,817.65 The Dow is down -6.56% Year-to-date.

- NASDAQ -38.59 or -1.62% to 2,341.84 The tech heavy NASDAQ is down -17% in the last 4 weeks or -11.72% Year-to-date.

- S&P 500 Index closed -17.12 or -1.50% to 1,123.53 -17.12 The S&P is down -9.9% Year-to-date.

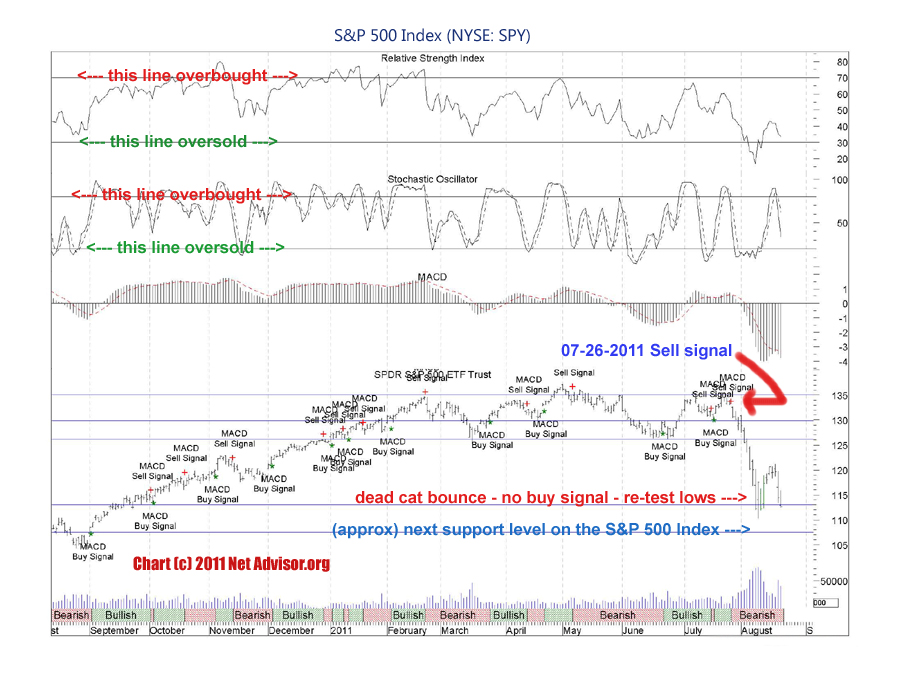

The Dow Transports had dropped -17.33% Year-to-date supporting Dow Theory of a sell-off risk. Our chart suggested a sell in the S&P on July 26, 2011.

[2] Foreign Markets (Some previous market leaders* now in a Bear Market). Year-to-date as of 08-19-2011.

- Brazil (Bovespa)* – 24.32%

- India (BSE Sensex)* – 21.30%

- Germany (DAX) -20.74%

- France (CAC-40) – 20.71%

- Hong Kong (Hang Seng) -15.78%

- China (Shanghi Composite) – 9.75%

[3] “Computer Crash”

Hewlett-Packard (NYSE: HPQ) suffered a technical crash on 08-19-2011 falling 20.3% to $23.60 – it’s worst single day fall since the October 19, 1987 Crash. A technical “Crash” is a 20% one day drop in a stock’s price from the previous closing price. HP traded 128.9 million shares or 4.6 times its average 3 monthly trading volume of 23.1 million shares. Other major companies including Bank of America (NYSE: BAC) and Citigroup (NYSE: C) also suffered recent single day (20%+) crashes in their stock prices.

In HP’s case they announced they were buying the UK’s largest software company, Autonomy for $10.3 Billion a 64% premium over Thursday’s 08-17-2011 closing price. HP also announced it was reducing its 2011 earnings outlook. The stock was subsequently downgraded and investors questioned HP’s business decisions over this buyout and concern for their lowered earnings outlook (Source: Reuters).

[4] Bank of America’s Nightmares

[4] Bank of America’s Nightmares

As for U.S. banks such as Bank of America, their problems seem to be magnified from their 2008 purchase of Countrywide Mortgage and perhaps to a lesser extent, but a costly one, the $40 billion purchase of Merrill Lynch also in 2008.

Two years before the real estate market peak (1986) and about the time when the FED began raising the FED Funds Rate, B of A pledged in 2004 that they would make $750 billion in loans over a ten-year period for “community development lending and investment” (Sources: wikipedia.org and Bank of America). According to the 2004 press release by B of A, the money would be loaned primary to “low-and-moderate-income (LMI) communities in the U.S.” (view BAC 2004 advertisement 2 page PDF (story link gone)).

Since then, Bank of America is now sitting on $1 Trillion in “problem home mortgages.”

“Bank of America Corp (BAC.N) plans to cut 3,500 jobs in the next few weeks as CEO Brian Moynihan tries to come to grips with the bank’s $1 trillion pile of problem home mortgages.”

— Source: Reuters, 08-19-2011

To save money from its decision to lend a lot of money to those who clearly had questionable capacity to ever repay the loans, B of A (like many other companies) began cutting their workforce. What should also be noted in the above Reuters article is that BAC is cutting 3,500 jobs in addition to the 2,500 jobs cut earlier this year (PDF); and may cut up to 10,000 jobs in 2011. With the 2008 acquisition of Merrill Lynch (completed in 2009), BAC was looking to cut about 30,000 jobs.

“Bank of America’s last big round of job cuts came as part of the 2009 Merrill Lynch acquisition. In that deal, the bank said it planned to cut up to 30,000 positions.”

A spokesman for B of A explained the job cuts this way:

“The company regularly assesses the efficiency of its businesses and at times makes adjustments to meet the opportunities in the marketplace,” spokesman Scott Silvestri said.

— Source: Los Angeles Times, 08-20-2011

Translated to layman’s terms it’s like this: ‘We really screwed up; the real estate market still sucks, and is going to for many years to come. The economy is also in the crapper despite what Goldilocks persons on TV will try and have you think. We’re looking at losses so big, that it would be cheaper to give blood, so we have to fire a bunch of people.’

[5] AIG vs. B of A

AIG – the failed, former largest insurance company in the world and still 80% controlled by the U.S. government is now suing Bank of America for $10 Billion including claims of various fraud and failed underwriting of mortgages through Countrywide (Sources: CNN and USA Today). Amongst issues within the legal complaint, AIG alleges that:

“Bank of America departed from its own underwriting standards…” (and made) “…irresponsible loans, very risky loans” (page 120, parr 319 of the AIG complaint).

— Source: AIG v Bank of America et al 193 page PDF (share the PDF link here)

AIG is not exactly an innocent party either. In September 2008 it became known that AIG issued credit default swaps in such quantity that they apparently did not have the cash to pay those insurance policies if certain counterparties failed. So if AIG the insurance company fails who will pay the insurance claims to help prevent more counterparties (large financial institutions) from failing? You guessed it: YOU – the U.S. tax payer.

“The biggest fears had to do with the credit-default swaps, which AIG appears to have sold in large quantities to practically every financial institution of significance on the planet. RBC Capital Markets analyst Hank Calenti estimated Tuesday that AIG’s failure would cost its swap counterparties $180 billion.”

— Source: Time.com, 09-16-2008; updated 10-01-2008

[6] Two Wrongs Don’t Make a Right

Bank of America acquired my top two “Companies currently in financial trouble in my opinion in this order” (1. Countrywide 2. Merrill Lynch – as listed in my Nov 2007 post (under ID: “NetAdvisor” on Yahoo! Answers). I won’t go into the 2007 letter I wrote to B of A (and other banks) warning of credit risks (saving that for later). The bank with its two new dead-weight pals, along with its own giant mortgage problems, has since graduated to take my spot for “#1 U.S. Bank (stock) at Risk.”

Notice that I placed both Countrywide and Merrill Lynch as “companies currently in financial trouble” back in November 2007. B of A bought Countrywide in January 2008, and Merrill in September 2008.

CNN’s Shawn Tully, “editor at large” said back on January 11, 2008 that “the Countrywide deal makes sense” (Source: CNN). We’ll, I guess we all make mistakes.

Bank of America stock is down -87% since November 2006 to date (chart). In my view B of A will need to raise capital (sell assets, spinoff bank parts, or sell more stock). How much I have no idea, but probably in the mega billions. If they don’t do this soon, and if they don’t get their problems handled quickly, there may not be too much of the common equity left in BAC.

[7] EU & USA Have Huge Challenges Ahead

As for Europe and the U.S. economy. In my view, the EU looks like their problems will get a lot worse before it gets better. Perhaps if France and Germany exit the EU to save their own economies and take some of the stronger EU members with them could help.

The only problem is that the rest of the EU problem counties currently (Portugal, Ireland, Italy, Greece and Spain) could technically collapse (risk default). If that were to happen, banks who have loaned these counties money including France, Germany, USA, etc., could then suffer collateral damage from the fall-out contagion of Europe’s bank or sovereign debt failure risk.

The European Central Bank or ECB just doesn’t have the money to bailout every country in Europe; they don’t even have enough money to bailout Italy.

“They caution that the (euro) 440 billion European Financial Stability Facility does not have enough money to intervene effectively on secondary markets to help large countries like Italy and Spain, and that divisions among countries, which all have to sign off on intervention, could delay any necessary action.”

— Source: Daily Herald (PDF), 08-09-2011

Note: 440 Billion Euros is about $663 Billion U.S. Dollars as of 08-22-2011 (Source: XE.com).

[8] How big is the EU Debt Crisis?

ECB President Jean-Claude Trichet said:

“It is the worst crisis since the second world war and it could have been the worst crisis since the first world war if leaders hadn’t taken the important decisions”

— Jean-Claude Trichet, President of the European Central Bank said in an interview with French radio station Europe. (Source: The Guardian.UK (PDF), 08-09-2011)

Italy reportedly will need a lot of cash to keep them going this year and then again next year.

“In the second half of 2011, Italy needs to raise 237bn euros (£206bn; $333bn) from the markets – and it will have to go back for another 296bn euros {or $427 Billion as of exchange rate to dollars on 08-22-11} in 2012. The comparable figures for Spain are 150bn euros and 159bn euros (or a total of $449.6 Billion in U.S. Dollars).

— Source: BBC News, 08-04-2011 [exchange rate to dollars on 08-22-11 by XE.com]

Thus based on the above data, the ECB needs about $842 Billion Euros by 2012 just for Italy and Spain’s bailout costs so far. The ECB only has $440 Billion Euros available. Does anyone else see the problem here or is it just me?

The question is if the ECB doesn’t have enough money to bailout European concerns, who will? And who will bailout the ECB if the underline bonds of sovereign nations collapse in value? Unfortunately at this time, we don’t see how that the ECB will be able to permanently keep all EU members intact and solvent with no failures. If they can do that with success, then the ECB can come to Washington DC to solve the U.S. debt crisis.

EU banks are also laying off. Europe’s largest bank HSBC plans to shed 30,000 jobs by 2013 (Source: NetAdvisor’s Aug. 1, 2011 Tweet/ story by Bloomberg).

I would argue that it is futile for anyone to think that the U.S. can just borrow more and more money and use that to bailout foreign governments. Who is going to bailout the USA when it’s our turn? We are placing U.S. at “elevated risk” by Mid 2013-ish, unless Congress stops playing kick-the-can and put bigger and bigger band-aids on the deficit spending problems instead of really addressing the problem by cutting government spending to be in-line with tax revenues.

Disclosure: Net Advisor™ and or clients may be holding long and or short positions in S&P 500 Index, currently short Bank of America (again) all via options that were also discussed in this report at time of original publish date.

Credits: Images copyright or are registered trademarks of their respective owners, Chart by NetAdvisor.org®

Original Content Copyright © 2011-2013 NetAdvisor.org® All Rights Reserved.

NetAdvisor.org® is a non-profit organization providing public education and analysis primarily on the U.S. financial markets, personal finance and analysis with a transparent look into U.S. public policy. We also perform and report on financial investigations to help protect the public interest. Read More.