January 13, 2011

The Great Train Wreck?

written by Net Advisor™

WASHINGTON DC. Voters in the November 2010 election are looking for change with the new 2011 Congress. Voter frustration with massive federal deficit spending and questionable policies such as government ran health care (“Obama Care”), and failed trillion-dollar stimulus programs that have not changed the unemployment rate, sent a new message to Washington. The real “reform” we need is government.

Republicans, and Tea Party candidates swept 60 Democratic seats in the November 2, 2010 election (Source: BBC News (pdf), (Election Map). This was the largest number of state legislative seats gained by the GOP since 1928 (Source: National Conference of State legislators).

“…The GOP in control of the most state legislative seats since 1928.”

— Source: National Conference of State legislators (PDF version).

With that said, clearly the American public has sent a mandate for government to rein in spending and control the deficit. The question is, does government have the will to make real financial change?

American’s Strongly Opposed to Raising the National Deficit Ceiling

A January 12, 2011 national poll found that 71 percent of those surveyed oppose increasing government borrowing (Source: Reuters/IPSOS).

Government Likely to Raise the National Deficit Ceiling Anyway

Despite this massive majority of Americans against increasing government debt, both major political parties seem to argue the idea that we must raise the national debt anyway. On January 6, 2011, Treasury Secretary Timothy Geithner urged congressional lawmakers to raise the deficit and argued that if they didn’t, that the result would create an economic catastrophe (Source: Reuters).

“Even a short-term or limited default would have catastrophic economic consequences that would last for decades,” Geithner said in a letter to U.S. Senate Majority leader Harry Reid, a Nevada Democrat.

— Source: Reuters

Some Republicans seem to agree with the Treasury Secretary words of apparent caution. federal and State government spending are the next economic problems to unfold.

On January 13, 2011, Todd Akin (R-Missouri) stated on CNBC-TV’s World-Wide Exchange program segment that (paraphrased slightly):

‘the United States takes in about $2 1/2 Trillion in taxes and other revenues and spends about $1 1/2 Trillion more than that.’

— Todd Akin (R-Missouri), CNBC-TV, 01-13-2011

Clearly government is like a crack addict when it comes to spending.

The Fear Trade

What we will hear for the next 3 months if not for eternity is that if the U.S. government does not raise the national deficit, then “U.S. soldiers will not get paid” and Social Security recipients won’t get their monthly checks. These examples were stated on the same aforementioned CNBC-TV program on Jan 13, 2011.

Government will use all the emotional and sympathetic arguments about the military and grandma to argue why we must raise the debt – again. These are the same old arguments used every time this matter is raised and government NEVER cuts spending by any material amount. All one has to do is look at the deficit each year and see it has gone up not down, regardless of the political rhetoric about freezing spending (temporarily) and trivial budget cuts.

Why Government Won’t Make Material Cuts in Deficit Spending

Two Words: Election and Votes. In an election year, which is every two-years, government leaders want to get re-elected. The people who tend to vote are the elderly and the retired. “The peak age group for voting participation is 65 to 74 years, where 72 percent of citizens voted in the 2000 election” (Source: U.S. Census Bureau – page 4 PDF).

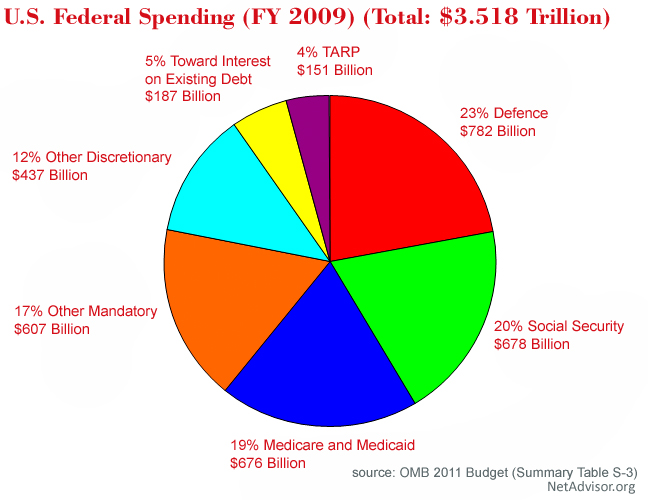

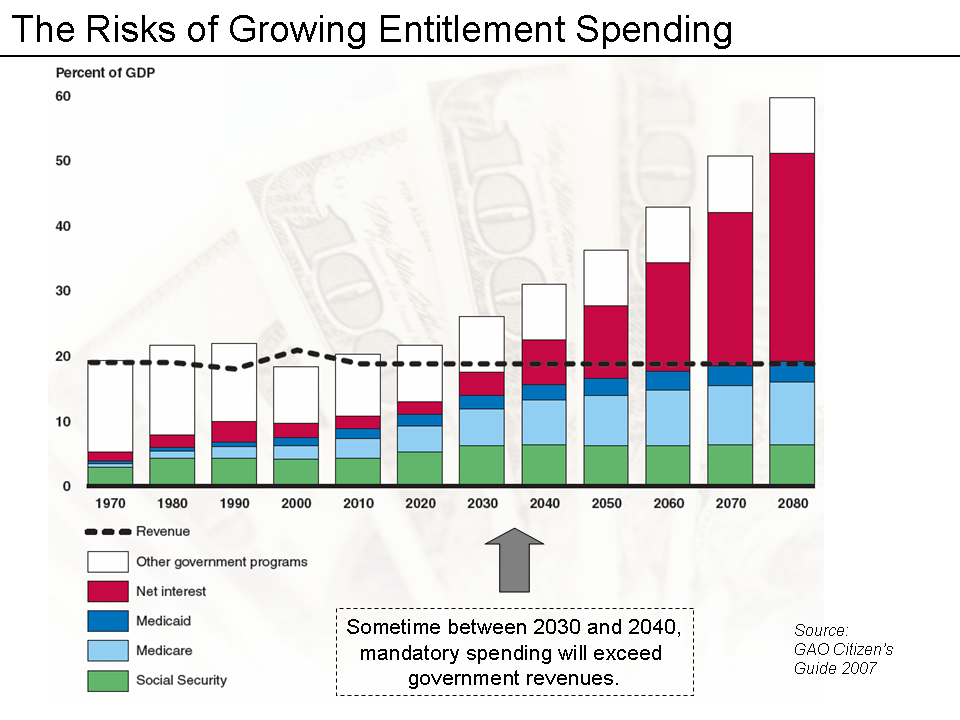

This group which is growing in size with the retiring baby-boomers also receives an ever growing portion of federal subsidizes such as social security, medicare and other entitlements (OMB chart below). Thus if one upsets this group of regular voters and cut their entitlements, there is a good chance that those in Congress who voted for such cuts will be ousted at the next election.

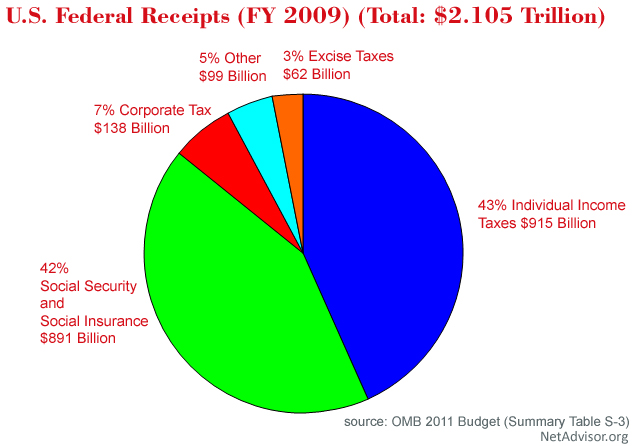

What is interesting and disconcerting is that the government just does not have the revenue to support the above spending. So where does government get its revenue? Borrowing via issuing of U.S. Treasury (debt) securities. Based on the chart below, about 54% of all U.S. government revenues for 2009 came from borrowing money.

Note that the U.S. government, via the Office of Management and Budget (OMB) considers debt (borrowing money) as “receipts” aka “revenue” (OMB chart below). So keep in mind that when you see financial and budget charts produced by government ask, what part of that is borrowed money and what part are real revenues?

How Will the U.S. Government Fix Its Debt Problem?

1. The U.S. is likely to keep increasing the retirement age to make it less likely for those paying into social security to ever receive it.

2. The U.S. will likely make medicare and related programs more expensive for those making “too much money” at whatever amount that may be, and likely will vary over the future. If government does not adjust this for inflation, what will happen is that those making even moderate incomes will eventually be deemed as the “wealthiest Americans.” An example of this problem is the Alternative Minimum Tax or AMT which was not indexed for inflation until the 2011 budget assuming this is not revised.

3. Former President Clinton suggested in 2010 that the U.S. should bring in more illegal aliens and that will help solve our deficit problem. That won’t work.

4. The U.S. will find infinite ways of raising taxes on everyone. The so called “wealthy” can turn over all their money and it won’t pay for the deficit. Thus all Americans will end up paying no matter what their income. One surprise the Obama Health Care supporters should be aware of is how payroll taxes and incomes taxes are going up.

“Buried in Nancy Pelosi’s health-care bill is a provision that will partially repeal tax indexing for inflation, meaning that as their earnings rise over a lifetime these youngsters can look forward to paying higher rates even if their income gains aren’t real.”

— Wall Street Journal, 11-06-2009

Basically what this means is that taxes are currently adjusted for inflation. But under the Obama Care, a partial repeal makes taxes go up even if income does not. Thus as deficits rise, the risk of inflation also rises, the result would be that Americans will be paying more taxes even if their incomes are the same.

4. Don’t be surprised to see increases in taxes on your cell phone bill, utilities (gas, electricity, heating oil) and any other government imposed tax on monthly bills.

5. The only way for government to control the debt is to spend less than they take in each year. The current spending of some $1.4 Trillion+ over what the government receives in revenue just will not work forever. Entitlements will grow each year eventually exceeding the total revenue of the U.S Treasury (chart below).

Government will likely increase the deficit and then make nominal deficit reductions and eventually build in (hide) tax increases such as Nancy Pelosi (D-California) did in the Obama Health Care Bill of 2009, unless that part is repealed by Republicans in 2011.

The ultimate outcome is likely that government will continue to increase the deficit until there is a bust (Great Train Wreck) that government cannot control. Then watch that impact financial markets, jobs, consumers, housing and the economy. The key is to take the necessary and big spending cuts now before we run out of track.

Image(s)/ graphics © respective owner(s)

Copyright © 2011 Net Advisor™

Revised Content Copyright © 2014 NetAdvisor.org® All Rights Reserved.

NetAdvisor.org® is a non-profit organization providing public education and analysis primarily on the U.S. financial markets, personal finance and analysis with a transparent look into U.S. public policy. We also perform and report on financial investigations to help protect the public interest. Read More.