07.25.2010 original report

07.28.2010 edit

10.22.2010 update (page bottom)

01.06.2011 repaired broken links

06.28.2011 minor editing for improved clarification

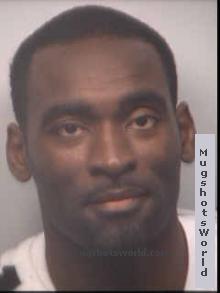

05.13.2013 photo of Carlo Joseph / AJC Article, more will follow as more info avail.

08.26.2014 repaired/ replaced broken links

Fraud Watch: CARLO JOSEPH INVESTMENTS, INC.

Investor Education Series – Investigative Report written by Net Advisor™

A full page investment advertisement has been circulating by at least one paper owned by the Los Angeles Times on Sunday July 25, 2010 that raises serious red flags. Keep in mind that newspapers and media do not pass on the merits of third-party advertisements. They take the money and print the ad. It is up to consumers, watchdog groups, and regulators to make assessments regarding advertising, and the merits of claims. This ad by Carlo Joseph Investments, Inc. raises a number of regulatory issues.

The advertisement claims that Carlo Joseph Investments, Inc. has a, “ROI (Return on Investment) as early as 3 months” and also states “100% rate of return.” There is a fine print disclaimer that states “rate of return is not guaranteed and may vary depending on deal-positioning for the future.” The ad shows a single line with the number “5,000,000+” It does not suggest a dollar amount nor does it make any attempt to describe or define the meaning of what “5,000,000+” is supposed to imply. Any vague language in an ad should also be exercised with greater caution, especially when money may be involved.

The advertisement is full page ad that depicts photos of a gold compass and a post sunset image of what appears to be a fishing boat along a harbor pier.

Red Flags

- The first red flag suggests making money on your investment as early as 3 months.

- The second red flag suggesting a 100% rate of return despite the disclaimer.

- The third red flag was also suspect. It states, “CJI raises $20 billion to $2 Trillion from worldwide cash partners to fund a wide range of opportunities.”

“ROI (Return on Investment) as early as 3 months”

Unless one is purchasing a publicly traded Real Estate Investment Trust or REIT that pays a monthly or quarterly dividend, one would need to see verified independent documentation how an alleged investment in real estate can pay you a return after 3 months.

It is very difficult for funds to generate immediate cash, especially in real estate.

“100% rate of return.”

This is a huge red flag. (1) It is unlawful for any investment company, registered investment advisor, broker, etc., to make any future assumptions, promises, or suggest future returns. If you ever owned a mutual fund, you will have seen the disclaimers on documents and when talking about returns, such as “past performance is not a guarantee, nor an indicator of future performance, etc. (examples of disclaimers appear in this search result).

Thus, I would argue that to say that one could get a “100% rate of return” would be a violation of U.S. securities law. I would further argue from a compliance point of view that one cannot say you can make a 100% return then disclaim that you may not. You might as well say you are investing in a fund that buys lotto tickets and you could win $300 million, but maybe not. That arguably is not a proper disclosure in advertising securities.

We do not know at this time if Carlo Joseph Investments, Inc. is operating a scheme or not. Based on the said advertising claims, it does mirror some of the red flags or warning signs that the SEC advises investors to look out for:

|

Pyramid Scheme

|

Ponzi Scheme

|

|

| Typical “hook” | Earn high profits by making one payment and finding a set number of others to become distributors of a product. The scheme typically does not involve a genuine product. The purported product may not exist or it may only be “sold” within the pyramid scheme. | Earn high investment returns with little or no risk by simply handing over your money; the investment typically does not exist. |

| Payments/profits | Must recruit new distributors to receive payments. | No recruiting necessary to receive payments. |

| Interaction with original promoter | Sometimes none. New participants may enter scheme at a different level. | Promoter generally acts directly with all participants. |

| Source of payments | From new participants – always disclosed. | From new participants – never disclosed. |

| Collapse | Fast. An exponential increase in the number of participants is required at each level. | May be relatively slow if existing participants reinvest money. |

— Chart source: SEC.gov

Highly Likely a Fraudulent Advertisement Statement:

“CJI (Carlo Joseph Investments, Inc.) raises $20 billion to $2 Trillion from worldwide cash partners to fund a wide range of opportunities.”

The largest IPO in U.S. history was the credit/ debit card company, Visa Inc. The company raised $17.9 Billion (Source: Reuters). Yet for some reason this unknown company, Carlos Joseph Investments (“CJI”) is able to raise no less than $20 billion minimum for its investments.

As a former registered FINRA Series 24 (Registered Principle) (About SR 24) I have extensive experience as a securities compliance officer, and I see some serious regulatory problems with this advertisement by Carlos Joseph Investments.

The ad is a solicitation.

The investment does not suggest to be holding any registered mutual funds. There are no standard mutual fund disclaimers or statements suggesting how securities are offered or how are they sold (by prospectus, by private offering circular, etc) . Thus, in the absence of mutual fund disclosures, I would draw the conclusion that these are private investments/ private investment funds. And if this is true, these private investments would then be subject to including, but not limited to SEC Regulation D (“Reg D”) and SEC Rule 504 which states in part:

“(Reg. D Securities) …does not allow companies to solicit or advertise their securities to the public.”

— Source: Securities and Exchange Commission (SEC), Rule 504 of Reg. D

The reason is that under SEC Rules 504, 505, and 506 to be able to have a registration exemption and sell securities (raise money), a company or entity can only make an offer to sell such securities to “Accredited Investors.” Read additional information under SEC Rule 501.The company cannot make a determination that by printing an ad, only accredited investors will look at it, or respond to it. This is why the SEC prohibits this kind of advertising under Regulation D.

Now I can get into further regulatory compliance issues and there are plenty to address, but right now, most people should read what other information I was able to locate on this firm.

The ad also boasts that Carlos Joseph Investments (“CJI”) is able to raise “$2 Trillion” for its investments. Let’s measure this against reality.

If Carlos Joseph Investments could raise $2 Trillion, that means they can raise more money that the total current value (market capitalization) of Exxon Mobil, Apple, Inc., Microsoft, Warren Buffett’s Berkshire Hathaway, Wal-Mart, Procter & Gamble, General Electric, IBM, JP Morgan Chase Bank, and AT&T combined!

— Market Cap as of market close 07-23-2010, per Yahoo Finance.

For some reason Carlos Joseph Investments, Inc. “$2 trillion fund” let alone a “$20 billion fund” didn’t appear on this list, or any verified money manger list.

Yet this company, Carlos Joseph Investments (“CJI”) claims to be able to raise all these billions and trillions of dollars yet, according to public records the company is currently in “non-compliance” to pay its $30.00 (thirty-dollar) annual fee to the Department of Corporations in the State of Georgia (Source: Georgia Secretary of State, as of 07-25-2010) Read their Corporate filings as of 07-25-2010 (file#1248766).

Not Registered in California

By placing an advertisement and thus soliciting investors in California, the company is thus attempting to do business in California which is also subject to California securities law. The corporation known as Carlo Joseph Investments, Inc. is not registered in the state of California (Source: California Department of Corporations Search).

One-Man Company?

Again, the company that claims to be able to raise billions to trillions of dollars, but apparently this company is registered all under one person. According to public records, the CEO (Chief Executive Officer), CFO (Chief Financial Officer – financials and accounting) and Corporate Secretary (record keeper) of the company are all registered as the same person: “CARLO JOSEPH,” and all registered at the same address: “3403 TUXEDO ROAD Atlanta GA 30305 (Source: Georgia Secretary of State, as of 07-25-2010).

It is unknown at this time if this same person, Carlo Joseph was involved and was the CEO, CFO and Secretary of another company that was “administratively dissolved” (by the State of Georgia) on 05-16-2008 (Source: Georgia Secretary of State).

Domain for Sale

The company also boasts other investment funds including “tuxedoroadinvestments.com” which is nothing but a domain name at this time. This domain was registered into existence in March 2009, and is showing “for sale” (Source: WhoIs.net).

The domain “carlojosephinvestments.com” was also registered into existence in March 2009. (Source: WhoIs.net) Keep in mind that by registering a domain name or making an advertisement is not a license to do business, nor does it validate the business into any legal existence, nor does it imply that it is complying with any federal or state law.

After doing a search from public regulatory data bases, I was not able to find anyone that exists with the exact name or registered investment company as advertised:

Returned “no match.” There were various “carlo joseph” with a middle names, or variations but the advertisement does not disclose his middle name, thus we need more information to do a match if any exists.

IARD person search “carlo joseph”

Returned “no match.”as a Registered Investment Advisor (RIA) individual.

IARD company search “carlo joseph investments”

Returned “no match.” as a Registered Investment Advisory (RIA) company. With the capital this alleged firm is boasting, they/he would be required to be registered with the SEC after managing $25 million. If he has under $25 million under management, and is making public solicitations such as the said newspaper and internet advertisements suggests, that would qualify as a public solicitation and Carlo Joseph et al would need to be registered where he is conducting business, including California where the advertisement was seen solicited.

“Investment advisers who manage $25 million or more in client assets generally must register with the SEC. If they manage less than $25 million, they generally must register with the state securities agency in the state where they have their principal place of business.”

— Source: SEC.gov

Bottom line:

This company should be investigated to determine where any laws have been violated or not. For those seeking to invest with this company, it is highly advised to seek an independent securities law attorney, and an expert financial adviser with private placement experience to evaluate the merits of their claims.

Check Out Advisors, Stockbrokers and Investment Firms:

Check out your broker for free: Finreg.org

Check out registered investment advisors (IA/RIA) (Series 65) for free: SEC.gov

Additional resources regarding advertising by non-registered persons: FTC.gov

____________________________________________________________________________

08.01.2010 Brief UPDATE: The same advertisement was published again in the same paper in the same location on 08-01-2010.

____________________________________________________________________________

10.22.2010 UPDATE:

The following is an update to Carlo Joseph Investments, Inc. We found some new information and updated previous information including ties to other businesses and their status.

PDF Documents – websites related to “Carlo Joseph Investments”

These documents are pdf’s from the domains stated below in case that the domain owners make attempts to alter the published information after this report is released. The pdf files automatically insert date created on the page.

- Carlo Joseph Investments.com – “official” website. Noted above the claims the site makes.

- tuxedoroadinvestments.com – registered domain related to “Carlo Joseph Investments” – showing: “may be for sale.”

- waterworksinvestments.com – registered domain related to “Carlo Joseph Investments” – showing: “may be for sale.”

- whitedoveconsultants.com – registered domain related to “Carlo Joseph Investments” – showing: “may be for sale.”

waterworks investments – a website was created on webs.com – make your own website for free. One might think if they really deal in “billions” and “trillions of dollars,” that one might be able to afford $10.00 a month for a website as opposed to using a free site that does not bear your own domain exclusively.

Waterworks Investments makes many claims including they have (deal in) “residential real estate includes luxury homes valued at over $500 Million.”

The previous most expensive home in the world according to WordlInterestingFacts.com is “the former home of Bill Gates, now belonging to Roman Abramovich, the Villa La Leopolda in Nice, France – USD $398 Million.” The property reportedly last sold for $750 Million in 2008. On 04-10-2010, overseaspropertymall.com said this property had value of $525 Million. Carlo Joseph Investments name was not listed anywhere in association, let alone having any ownership interest in this property.

Overseaspropertymall.com also states that the most expensive home in the world in 2010 is owned by Mukesh Ambani, not by Carlo Joseph Investments. Mukesh Ambani is the world’s fifth richest man (Source: Forbes).

Waterworks Investments website further claims,

“Capital partners, Joint Venture Capital Partners, and institutional Capital Partners may invest capital toward our real estate purchases and receive up to 100% ROI (return on investment) within a short time period ranging from1 to 2 years.”

Waterworks Investments website makes no representation, or provides any evidence how they can double your money in real estate or make any money in any investment.

Waterworks Investments website shows contact information of:

1266 West Paces Ferry Road, Suite 695

Atlanta, GA 30327

1-800-793-2143

D&B Page?

Carlo Joseph Investments Dunn & Bradstreet page states “est sales $100,000 t0 $350,000.” (We don’t know if this has been verified). We are also not sure how anyone can buy a “$500 million home” if they only have $350,000 in annual sales?

Advertisements

12-2007 Carlo Joseph Investments advertising claims. (Published by: Response Magazine)

10.27.2008 Carlo Joseph Investments apparent interview makes the following claims:

- “bought two Gulfstream G5s” (about $37.5 Million each (2002) $42 Million each in (2010).

- “packaging a deal that includes the purchase of 1,000 sprawling mansions (in Atlanta, GA)…(with) a (total) value of more than $1 billion even in the current real estate-market slump.”

- “Joseph said have put up at least $10 million in cash-some as much as $100 million–is one of his “Tuxedo Investments” portfolios.” (Mr. Carlos Joseph might want to take out $60.00 (sixty-dollars) from his “personal” alleged $10 million cash investment to pay the State of Georgia his corporate registration fees for the last 2 years.)

- “Other transactions and investment opportunities Joseph is currently or has been at the helm of include:

* Five upscale hotels and five luxury apartment purchases worth an estimated $7 billion

* A high-volume, high-end alcoholic beverage establishment (aka “bar” or “night club?”)

* A $650-million Panamanian construction project.”- (Has) “20-plus silent investors.”

The above (1-5) points are quoted and originally published by San Fernando Valley Business Journal (California); published on-line by AllBusiness.com)

If Mr. Carlos Joseph claims to be able to raise $20 Billion to $2 Trillion and he has “20-plus silent investors,” that would suggest that all the investors would have to be on the top Forbes List. Each investor would have to have a minimum of $1 Billion in cash to contribute in Mr. Joesphs’s alleged “investments.” And this only meets the bottom-line bare-minimum claims of $20 Billion of investment assets. Once again, as said on 07-25-2010, one could take all the combined stock value from the Top S&P 500 companies, liquidate them all to cash, close all the businesses and one still could not add up to $2 Trillion. We would argue that Mr. Carlos Joseph’s advertised statements are not consistent with any verifiable fact(s).

Corporate Status

03.25.2009 Carlo Joseph Investments, Inc. (Georgia) Corporation

Status: “Active/Noncompliance“ (Source: Georgia Secretary of State. Apparent Reason – non-compliance: 2 Years Past Due Annual state registration fee. Amount Due: $60.00 (sixty-dollars). (State of Georgia, PDF); (Corporate Records: State of Georgia, HTML; Our PDF Copy).

10.31.2009 Carlo Joseph Investments, Inc. (Nevada) Corporation

Status: “Default” (Source: Nevada Secretary of State pdf as of 10.22.2010; HTML version).

04.06.2010 Water Works Investments, Inc. (Nevada) Corporation

Status: “Revoked” (Source: Nevada Secretary of State pdf as of 10.22.2010; HTML version).

04.06.2010 Tuxedo Road Investments, Inc. (Nevada) Corporation

Status: “Revoked” (Source: Nevada Secretary of State pdf as of 10.22.2010).

05.12.2010 GOLD AND MINERALS DEVELOPMENT, INC. (Nevada) Corporation

Status: “Active” [Source: Nevada Secretary of State ( HTML version)] Company lists a David A. Hite of Las Vegas as Registered Agent, Secretary and Treasurer in corporate records. Carlo Joseph listed as President and Director.

06.28.2010 Water Works Investments, Inc. (Georgia) Corporation

Status: “Active/Noncompliance“ (Source: Georgia Secretary of State pdf as of 10.22.2010).

We have not searched all states, just states above.

Legal Actions

08.31.2010 Article: “Regulators-tell-MadeOff-to-knock-it-off.” Carlo Joseph Investments (CJI) is mentioned by Nevada Secretary of State, who apparently issued a “Cease-and-Desist Order” against (CJI) for allegedly selling unregistered securities in the state of Nevada. (Source: Las Vegas Review Journal). Probably not a good sign to be named in the same news article with Bernie Madoff.

10.04.2010 State of California Desist Refrain Order v. Carlo Joseph, Carlo Joseph Investments, Inc. and Water Works Investments, Inc. for allegedly selling unregistered securities in the state of California in violation of state securities law. (State of California Summary Actions – PDF.)

We have not done a complete check for any other enforcement actions if any. The above public records were all found via Google with a little expertise in key word searches.

Despite the aforementioned information, Carlo Joseph Investments, Inc. website continues to boast unsupported claims.

We invite Mr. Carlo Joseph and anyone from any of the entities named hereto and contact our media organization to discuss anything about these matters.

____________________________________________________________________________

05.13.2013 UPDATE: Legal Actions

01.27.2012 Carlo Joseph was reportedly arrested on 01-27-2012 in Atlanta, GA [Atlanta Police Booking #1203728]. According to Fulton County Sheriff’s Department, Carlo Joseph was charged with four counts.

| Charge | GA Statute | |

|---|---|---|

| EMPLOY DEVIS SCHEME DEFRAUD | 10-5-50 | |

| FAIL TO REGISTER AS AGENT | 10-5-31 | |

| FAIL TO REGISTER SECURITIES | 10-5-20 | |

| MORE THAN $500.00 (Theft by deception) | 16-8-3 |

Chart Source: Fulton County Sheriff’s Department. GA Statute links: law.justia.com

02.01.2012 According to Fulton County Sheriff’s Department, Carlo Joseph was released on $40,000 bond.

According to this report:

“Georgia pursued a criminal case, and in October 2012 in Fulton County, he pleaded guilty to theft by taking and violating the Georgia Uniform Securities Act. Joseph was allowed to serve his sentences on probation, and the court said probation would be suspended after restitution was paid in full to the victim.”

— Source: The Atlanta Journal-Constitution (PDF)

As of 05-13-2013, Mr. Joseph has not contacted our company for an interview. If you know anyone who invested money with Mr. Joseph or any of the named companies in this report, please contact us. We are still reviewing this matter in other states. An update will follow when available.

______________________________________________________________________________

Any items that are “striked out” in our articles are either moved, removed or otherwise broken links. We have over 10,000 links in our reports. We try and repair these links when we can find updates if known. Please advise if repair is needed.

Copyright © 2010-2011 Net Advisor™

Revised copyright © 2012-2014 NetAdvisor.org® All Rights Reserved.

NetAdvisor.org® is a non-profit organization providing public education and analysis primarily on the U.S. financial markets, personal finance and analysis with a transparent look into U.S. public policy. We also perform and report on financial investigations to help protect the public interest. Read More.

____________________________________________________________________________